LIFE IS A PARTY!

Celebrate life with us – and your future. Treat yourself to the 50% Wayfair subsidy for your OP. Want to know how? We’ll tell you in a face-to-face chat!

An occupational pension (OP) is a collective term for all the financial benefits that an employer promises to its employees for their retirement. At Wayfair, we’re splashing out and chipping in with a whopping 50% of your personal savings!

But it doesn’t stop there. Everything we save together with you, we can pay directly from your gross salary. That’s why your OP operates tax-free during the savings period, and you also save on social security contributions.

See? It pays off twice!

Our OP gives you a sensible way of compensating for losses in statutory pension insurance – and helps you take control of your future.

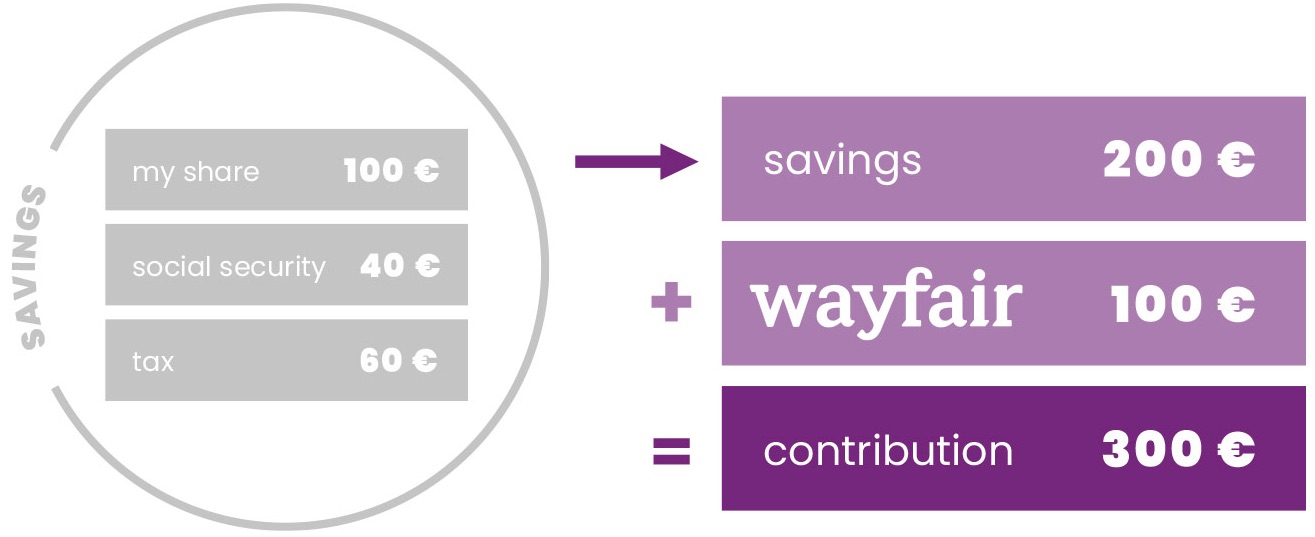

Imagine putting €100 net into your OP each month. This will save you €40 in social security contributions and €60 in tax, depending on your gross salary and tax band.

Curious? Get an overview of the many financial benefits an OP has to offer!

Do you want to know exactly how an OP works, and what benefits it offers you? We’ll explain everything in detail here.

As a young person, you don't have the financial means to put aside a decent amount for a long time. Thanks to the employer’s subsidy and state funding a minimal contribution quickly turns into a considerable amount.

Over the course of your life, another advantage you really get to appreciate is that you don’t have to pay any taxes during the time you are saving. And you don’t have to pay social security on a portion of your contributions, since it is deducted directly from your gross salary.

– in choosing your contribution amount and payment method, and when moving or changing jobs. There are also special solutions for that.

Obviously, because of the gross/net effect, you pay the whole contribution – but you are still left with about half the net amount (depending on the tax band at the time).

Albert Einstein called it the most powerful force in the universe. What the smart man meant was that by (re)investing interest, you’ll get interest on that interest. The result: compound interest. This superpower helps you increase the savings you make over the years exponentially. Wowzers!

Since 2019, employers have been obliged to add at least 15% of your contribution. At Wayfair, employees even receive a subsidy of 50%! Until your retirement, your savings will grow steadily thanks to interest rates, surpluses from insurers and returns on the capital market. Even in times of low interest rates, you can’t lose anything.

Retrospective taxation is seen as a supposed shortcoming of an occupational pension. It is only due once you put down your pen for the last time and retire. But since your income will be lower than when you were still working, the taxes will also be much lower.

“Hi, I took part in your presentation and just wanted to tell you that I loved it! You hit just the right tone and made it fun and appealing without any clichés or exaggerations. No coffee was needed and you shared all the relevant information. Thank you very much :)”

– Piotr, employee at Scout24